Clark Wealth Partners for Beginners

Table of ContentsFacts About Clark Wealth Partners RevealedHow Clark Wealth Partners can Save You Time, Stress, and Money.Not known Incorrect Statements About Clark Wealth Partners The Main Principles Of Clark Wealth Partners The Ultimate Guide To Clark Wealth PartnersUnknown Facts About Clark Wealth Partners9 Simple Techniques For Clark Wealth Partners

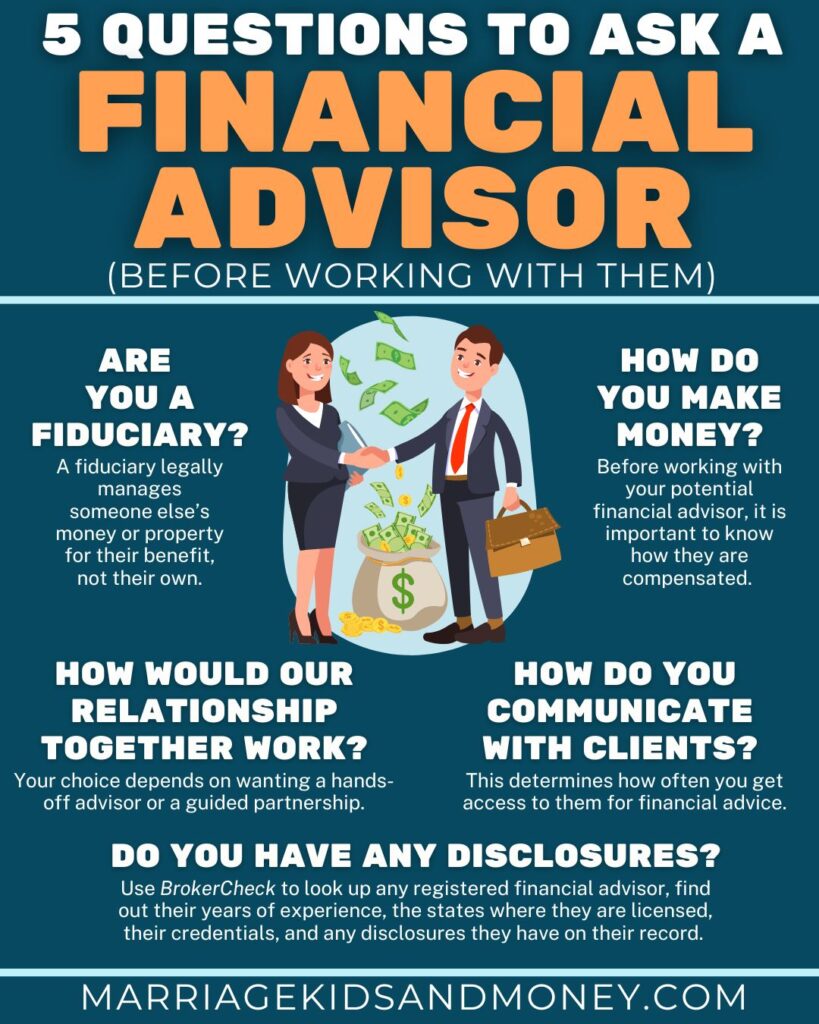

The globe of money is a difficult one. The FINRA Foundation's National Ability Research Study, as an example, recently discovered that nearly two-thirds of Americans were unable to pass a fundamental, five-question economic proficiency examination that quizzed participants on topics such as passion, financial debt, and various other reasonably basic principles. It's little wonder, then, that we typically see headlines regreting the inadequate state of the majority of Americans' finances (financial advisor st. louis).Along with managing their existing clients, economic advisors will certainly usually spend a fair quantity of time every week meeting with possible clients and marketing their solutions to keep and grow their organization. For those considering ending up being an economic consultant, it is necessary to think about the typical salary and work security for those operating in the area.

Programs in tax obligations, estate planning, financial investments, and danger administration can be valuable for pupils on this course. Relying on your one-of-a-kind occupation objectives, you may additionally require to gain particular licenses to satisfy specific clients' demands, such as dealing stocks, bonds, and insurance coverage. It can also be valuable to gain a certification such as a Certified Economic Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

What Does Clark Wealth Partners Mean?

What that looks like can be a number of things, and can differ depending on your age and stage of life. Some people stress that they require a particular quantity of cash to invest before they can obtain aid from a specialist (financial company st louis).

Clark Wealth Partners Fundamentals Explained

If you haven't had any experience with a financial expert, below's what to anticipate: They'll begin by offering a comprehensive evaluation of where you stand with your possessions, liabilities and whether you're satisfying standards contrasted to your peers for savings and retirement. They'll assess short- and lasting objectives. What's handy about this step is that it is personalized for you.

You're young and working complete time, have a car or two and there are pupil financings to pay off.

Clark Wealth Partners Can Be Fun For Anyone

Then you can discuss the following best time for follow-up. Prior to you start, ask concerning pricing. Financial consultants generally have various rates of rates. Some have minimum possession degrees and will bill a fee normally numerous thousand bucks for creating and readjusting a plan, or they may bill a level fee.

You're looking in advance to your retirement and aiding your kids with higher education and learning expenses. A monetary advisor can provide advice for those circumstances and even more.

The Greatest Guide To Clark Wealth Partners

Arrange routine check-ins with your planner to modify your strategy as needed. Stabilizing financial savings for retirement and college expenses for your kids can be tricky.

Considering when you can retire and what post-retirement years may look like can generate worries about whether your retirement savings are in line with your post-work strategies, or if you have actually conserved enough to leave a heritage. Aid your financial specialist comprehend your strategy to money. If you are more conventional with saving (and possible loss), their pointers need to react to your fears and issues.

The Ultimate Guide To Clark Wealth Partners

For example, preparing for healthcare is among the big unknowns in retirement, and an economic professional can detail options and recommend whether additional insurance as defense might be practical. Before you start, attempt to obtain comfortable with the concept of sharing your entire financial picture with a specialist.

Offering your professional a full picture can help them develop a strategy that's focused on to click here for info all components of your monetary standing, especially as you're quick approaching your post-work years. If your funds are straightforward and you have a love for doing it on your own, you may be great on your very own.

An economic consultant is not just for the super-rich; any individual dealing with significant life shifts, nearing retired life, or feeling overwhelmed by monetary decisions might take advantage of expert advice. This short article checks out the role of financial advisors, when you might need to speak with one, and vital factors to consider for choosing - https://padlet.com/blancarush65/clark-wealth-partners-eb2eezozlg16amlq. An economic consultant is a trained expert who assists customers manage their financial resources and make educated decisions that align with their life objectives

Clark Wealth Partners for Beginners

In comparison, commission-based experts make revenue with the economic products they sell, which may influence their suggestions. Whether it is marriage, divorce, the birth of a child, profession modifications, or the loss of a liked one, these events have unique financial implications, often needing prompt choices that can have long-term effects.